Why stocks aren’t sweating the commodity decline

Source: Bloomberg and Capital Index

Usually when commodity markets move sharply it can spell danger for the broader financial markets. Thus, the sharp decline in some metals on the back of global trade war fears, and the overall malaise in the commodity markets might be a warning sign that other asset classes could be at risk from a similar decline.

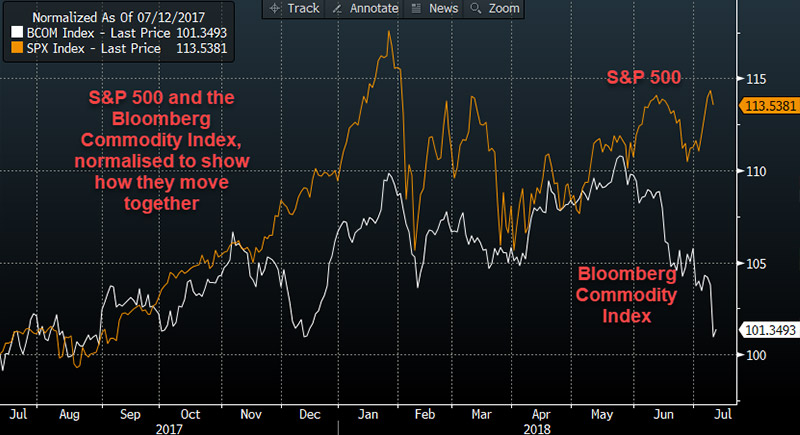

Not so this time around. The chart below shows the S&P 500 and the Bloomberg Commodity Index, it has been normalised to show how the two indices move together. As you can see, commodities and stocks have diverged since May and this divergence has gathered pace in recent days as the commodity sell off has strengthened on the back of fears of a global trade war.

Why are stocks showing such resilience in the face of the commodity sell off? The reason is earnings season. Analysts are expecting a bumper US earnings season, and, so far, they have not been disappointed, with average earnings growing by 25% for companies that have already reported for Q2. While it is still very early in earnings’ season, the fact it has got off to a good start has been enough to push the S&P 500 to its highest level since February. Upbeat earnings have also bolstered US stocks from concerns about the global trade war, which is impacting other asset classes like commodities and FX.

So what is next for stocks? While earnings season is still in full swing, as long as US firms continue to meet or exceed analyst estimates then we may see US stock indices continuing to perform well even though commodity prices are coming under pressure. Thus, unless we see a major upset in earnings season, the divergence between stocks and commodities could continue.