UK banks brush off EU access fears as US inflation fails to move the Fed’s dial

Source: Bloomberg and Capital Index

US CPI was in-line with expectations for June, suggesting that prices are rising at a manageable rate. The annual rate of headline inflation rose to 2.9% from 2.8%, while core prices rose to 2.3%, the highest level in 2 years. The dollar index, which had rallied into the data, backed away from Thursday’s intra-day highs at 94.94, as the latest price data from the US doesn’t significantly move the dial when it comes to Fed rate hike expectations for the rest of this year.

The market is expecting one further rate hike, most likely in December, however, expectations for a fourth hike this year hang in the balance, with the market pricing in a 50% chance of a hike by year-end. This data is unlikely to shift expectations that a further rate hike is imminent, hence why the dollar has backed away from recent highs on the back of this report.

Why Trump’s tariffs may not worry the Fed

In terms of the longer term-trend in US prices, the 3-month rolling core sticky CPI price index has actually fallen back from the high reached in February, which suggests that inflation pressures may be moderating, and we could be near the peak for US prices this year, which could also weigh on the buck. Of course, the Trump trade tariffs could cause inflationary pressures, it will be interesting to see if the Fed will look through inflation caused by tariffs when it next sets policy.

Brexit White Paper fails to spook markets

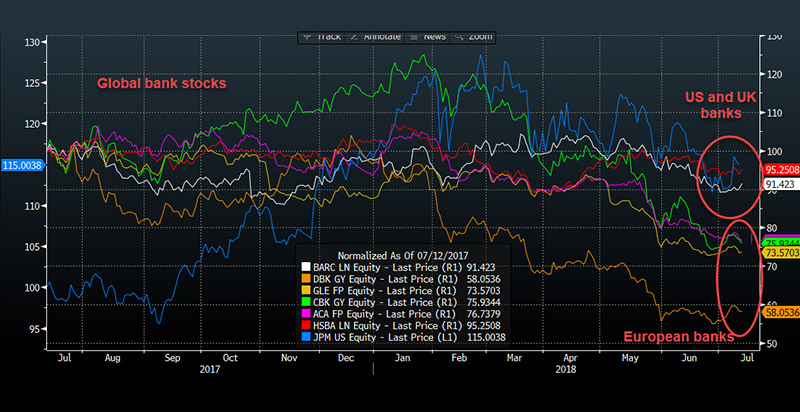

Elsewhere, the UK Government’s white paper on its latest Brexit plan was announced to the Parliament today. This was mostly as expected, with trade in goods mostly protected from the UK’s withdrawal from the EU, while services and finance will have much looser ties. Considering the focus on the finance sector’s relationship with the EU, UK bank stocks have been remarkably resilient to the news, as you can see in the chart below.

The FTSE 100 is up nearly 1% so far on Thursday and is the second best performing index in the European space. The UK’s finance sector is up more than 1.1%, with UK banks up 1.25% so far. The two biggest banks, including HSBC and Barclays, are up some 1.5%, while Lloyds and RBS are nearly 1% higher. The resilience of the UK’s biggest banks is unsurprising since they can well afford to set up multiple offices across Europe, however, the relative disadvantage for the UK’s smallest banks is one reason why Standard Chartered, a smaller investment bank, is a relative under-performer on Thursday. It is worth noting, that Standard Chartered may also be suffering because of its links to emerging markets that are currently at risk from US President Trump’s trade wars.

UK vs. European banks, no contest

Interestingly, UK banks have not under-performed vs. their European counterparts during this pivotal period of Brexit negotiations. As you can see in the chart below, HSBC and Barclays have outperformed their European rivals since April. Deutsche Bank is the weakest performer in this group, which is unsurprising due to the internal problems at the German behemoth. What is interesting, is that French banks have also had a lacklustre performance in recent months. This suggests that the prospect of Frankfurt or Paris taking financial business away from London as a result of Brexit, is not yet reflected in the share price of the European banks.

The chart below shows that the biggest outperformer is US bank JP Morgan, suggesting that the market could be expecting the US to take business away from London, not Europe. However, we believe that investors may continue to take an interest in UK banks as they look ahead to potential opportunities for London from breaking away from EU rules and regulation. This could be good news for the FTSE 100 given that the banking sector makes up 12% of the entire index.