-

9November, 2020

The dollar edged lower on Monday morning in the Asian trading session. The dollar started its week with losses amidst Joe Biden’s victory in the U.S. Presidential Elections.

The U.S. Dollar Index edged down 0.14% to 92.168 by 10 PM ET (2:20 AM GMT).

Investors dumped the dollar over expectations that a Biden victory would mean a steadier U.S. foreign policy and a soft monetary policy, as announced by the Federal Reserve during the previous week.

“The dollar weakened in anticipation of a Biden presidency bringing calmer politics … and anticipation of Fed coming to the rescue again amid near term risk of rising COVID infection,” Bank of Singapore FX analyst Moh Siong Sim told Reuters.

On Sunday, Joe Biden won over the state of Nevada and Pennsylvania by obtaining 270 electoral votes needed to win against incumbent president Donald Trump.

However, Trump still refuses defeat and seeks to continue legal action to have a clear result. Adding to the uncertainty is which party holds the Senate majority, with four races yet to declare winners, some investors warned that it was too early to say whether the market volatility has finally calmed down.

“We caution that heightened volatility is not necessarily behind us, even though the election result is all but settled,” Commonwealth Bank of Australia currency analyst Kim Mundy said in a note.

However, some investors are still having hopes in the Republicans to retain their majority in the senate and to further boost stocks but unfortunately puts downward pressure to the dollar.

“Republican control of the Senate is likely to see them dump the economic populism of President Trump and pursue a material decline in the U.S. fiscal deficit, which is set to underpin a large fiscal drag in 2021,” Perpetual head of investment strategy Matt Sherwood told Reuters.

“That means 2021 growth will now be more dependent on the U.S. Fed,” Sherwood added, as well as Covid-19 vaccine, both of which would be negative for the greenback.

Technical Outlook

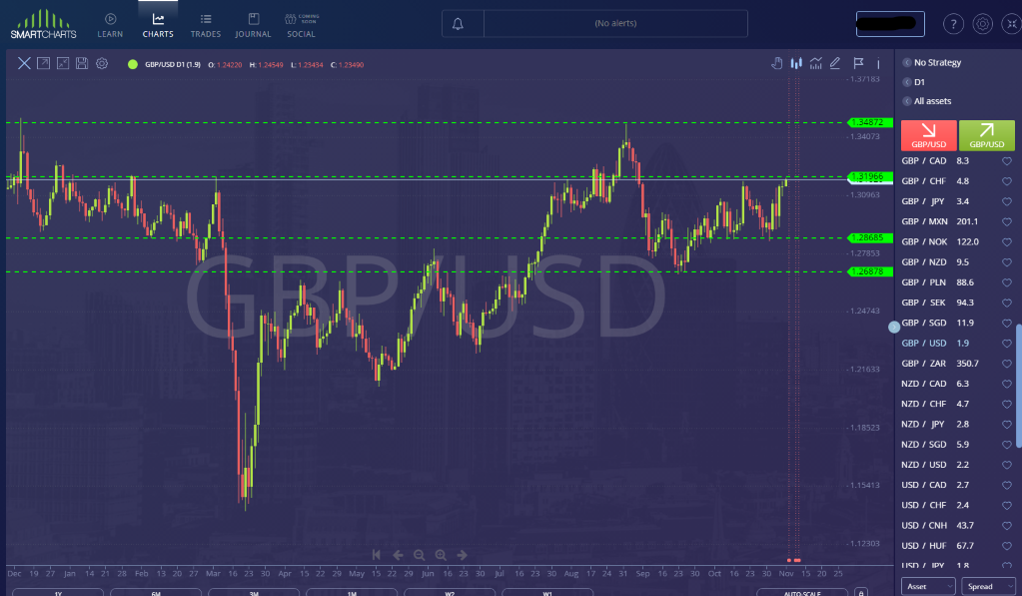

In the daily charts of GBP/USD, the sterling gained against the dollar early Monday morning in the Asian trading session.

In the chart, we can see that the current price is testing the resistance at 1.31966. The pound has been in a bullish outlook since last week. We can hope for the pair to breakout from this resistance level and expect the price to edge higher and test the resistance at 1.34872.

However, if the price continued to resist at 1.31966, we can expect the price to edged lower and re-test the support level at 1.28685. The weakening dollar upon the victory of Biden is most likely a positive for the sterling and there is a high probability that the pair will break out from the resistance in 1.31966 and further push pair higher in the coming days.

Don’t forget to follow and subscribe for more updates about market trends, analysis, forex news, strategies and more!

Do you want to learn more about forex trading? Sign up now on our FREE forex webinar and reserve your FREE seats while it still lasts!

Risk Disclaimer:

Information on this page is solely for educational purposes only and is not in any way a recommendation to buy or sell certain assets. You should do your thorough research before investing in any type of asset. Learn to trade does not fully guarantee that this information is free from errors or misstatements. It also does not ensure that the information is completely timely. Investing in the Foreign Exchange Market involves a great deal of risk, resulting in the loss of a portion or your full investment. All risks, losses, and costs associated with investing, including total loss of principal and emotional distress, are your responsibility.

By bsuper

| No Comments