-

11November, 2020

On Wednesday, the dollar was down amidst surge of new cases in Covid-19 and talks of how a Coronavirus vaccine will be delivered earlier in the week.

The U.S. Dollar Index inched down 0.6% to 92.648 by 10:03 PM ET (2:03 AM GMT)

On Monday, Pfizer Inc and BioNTech released a positive interim phase III results from their Covid-19 vaccine candidate BNT-162b2 with results that 90% of the vaccine was already effective in preventing infection. The U.S. dollar surged up on Monday upon the release of the news.

However, the dollar went down on Tuesday and Wednesday with concerns about logistical hurdles such as shipping the vaccine at extremely cold temperatures and other hurdles, such as the vaccine’s efficacy and longevity. This sentiment curbed investor’s enthusiasm in the dollar and they had to sought out other riskier currencies.

However, some investors remained cautiously optimistic over the dollar’s long-term prospects.

“The dollar recovery is on hold for now because, when you look at the details, there are still a lot of hurdles to clear before any vaccine is rolled out … however, the dollar is supported by rising Treasury yields, which should help the dollar make another push higher before the year’s end,” IG securities senior foreign exchange strategist Junichi Ishikawa told Reuters.

The continuing second wave of coronavirus cases in U.S. led to restrictions in some states with over 51 million global cases recorded as of Nov. 11 over 10.2 million cases are in the U.S.

Meanwhile in the GBP/USD currency pair, the pair inched up 0.05% to 1.3264. The pound is reaching it’s two-month high over hopes in reaching a Brexit deal between the U.K. and European Union. The talks between two sides resumed on Monday in London.

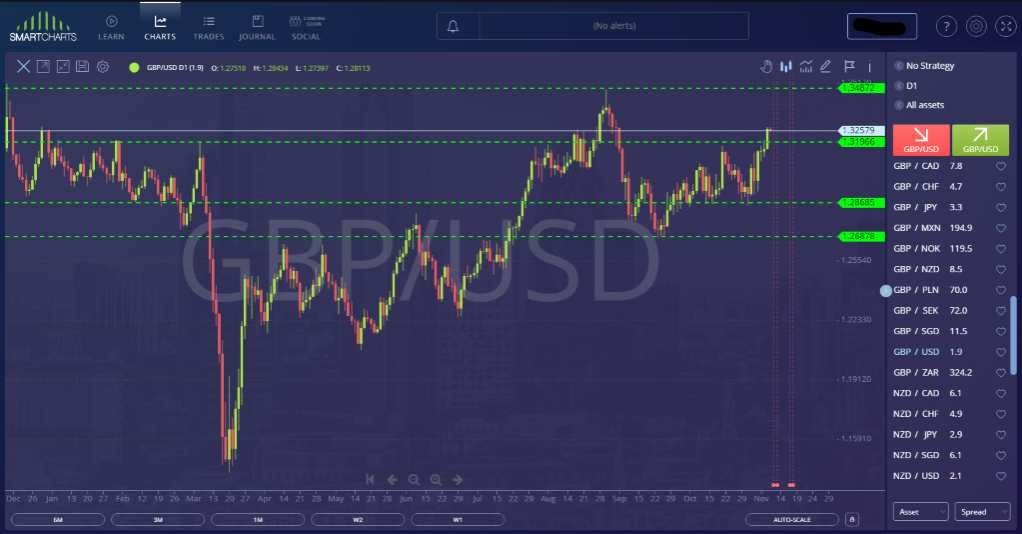

Technical Outlook

In the daily charts of GBP/USD, the pound inched higher against the dollar early morning in the Sydney session.

As what we can see in the charts, the pair broke out from the resistance level at 1.31966 yesterday. With the ongoing talks of a possible Brexit-deal between the U.K. and European Union, we may see a strong upside pressure against the dollar.

With the dollar falling against hopes in the coronavirus vaccine, the pair may continue to surge up and test the resistance level at 1.34872. Once the price breaks from this resistance level, the pound would reach its new highs against the previous high it reached last August.

However, if the price broke down from the support level at 1.31966, we can expect the pair to test the support level 1.28685

Don’t forget to follow and subscribe for more updates about market trends, analysis, forex news, strategies and more!

Do you want to learn more about forex trading? Sign up now on our FREE forex webinar and reserve your FREE seats while it still lasts!

Risk Disclaimer:

Information on this page is solely for educational purposes only and is not in any way a recommendation to buy or sell certain assets. You should do your thorough research before investing in any type of asset. Learn to trade does not fully guarantee that this information is free from errors or misstatements. It also does not ensure that the information is completely timely. Investing in the Foreign Exchange Market involves a great deal of risk, resulting in the loss of a portion or your full investment. All risks, losses, and costs associated with investing, including total loss of principal and emotional distress, are your responsibility.

By bsuper

| No Comments