-

The Pound has been building its bullish momentum since its fall from the breakout of the pandemic last March 2020. Nearing the end of March, the bulls pushed the price up relentlessly.

However, the bullish momentum seems to slowly fade from it’s 5-month highs and an indecision in the market is starting to form a rally from the current prices since Thursday this week.

In its outlook on the economy, the central bank estimated that the economic impact of the coronavirus pandemic would be less than initially feared. Due to this event, inflation can be expected to return to its previous target of lowering interest rates in just two years and the GDP(Gross Domestic Product) to fall 9.5% for the year below the previous forecast for a 14% decline.

The central bank adopted such dovish tones regarding cutting rates below zero with Bailey suggesting negative interest rates policy (NIRP) but it is still uncertain as to when such tool could be used.

“So, while the MPC acknowledged that the risks to growth outlook remain hugely skewed to the downside, for the time being it sees no need for additional stimulus.” Daiwa Capital Markets added.

Despite the less dovish tones of the central bank and Bank of England, we can clearly see that the pound is having an indecision in the market to raise prices higher.

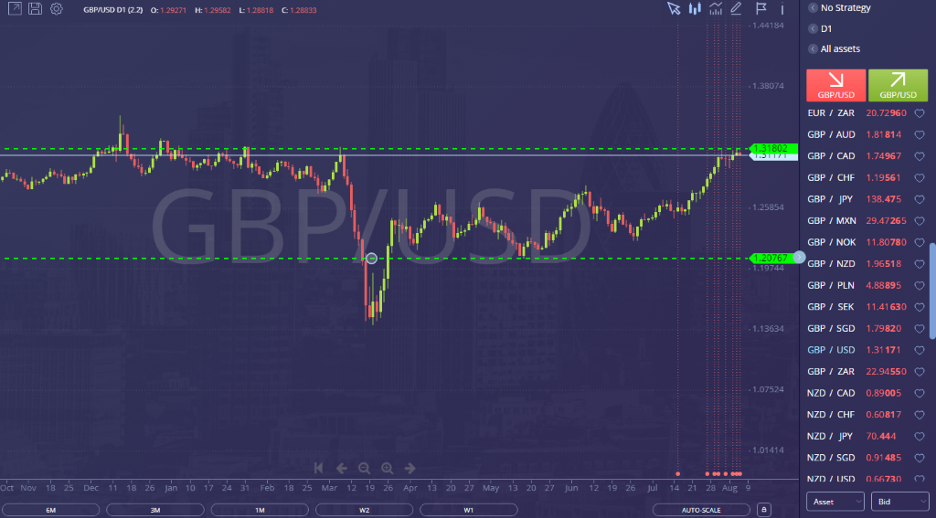

Technical Outlook

After the Bank of England’s dust settled, the GBP/USD consolidated in the 1.318sh price zone. The indecision in the market makes it hard for either the bulls or the bears to position their trades as risk is most likely to be the first thing that would come into their minds and more questions arise that will impact especially most intraday traders.

Will the pound continue its sideways trend for the coming week? Will it finally break out and continue its 5 months high? Will the bears start to take profit and pull the price lower?

For more updates on Forex news and analysis, don’t forget to like and follow us for daily updated contents in your news feed!

Are you interested to learn more on Forex? Sign up now for our FREE forex webinar and reserve your FREE seat while it still lasts!

Risk Disclaimer:

Information on this page are solely for educational purposes only and is not in any way a recommendation to buy or sell certain assets. You should do your own thorough research before investing in any type of asset. Learn to Trade does not fully guarantee that this information is free from errors or misstatements. It also does not guarantee that the information is completely timely. Investing in the Foreign Exchange Market involves a great deal of risk which may result in the loss of a portion or your full investment. All risks, losses and costs associated with investing, including total loss of principal and emotional distress, are your responsibility.

By bsuper

| No Comments